What is an Entity?

An Entity is a company, organization, either for-profit or non-profit, or government agency that is designated to act as an Authorized Individual for one or more ABLE Eligible Individuals.

What is an Authorized Individual?

The Authorized Individual is the person or Entity either 1) designated to act on the Account Owner’s behalf with respect to the Account if the Account Owner lacks Legal Capacity (Legal Capacity is determined by applicable state or district law) to exercise signature authority over the Account, or 2) is the person or Entity designated by an Account Owner with Legal Capacity as the Account Owner’s agent under power of attorney to exercise signature authority over the Account.

When can an Entity serve as an Authorized Individual?

The Entity can serve as the Authorized Individual on ABLE Accounts if the Entity is either:

(1) designated by an Eligible Individual with Legal Capacity (Account Owner) as the Eligible Individual’s agent under power of attorney to establish and manage the ABLE Account on the Eligible Individual’s behalf, or

(2) if the Eligible Individual does not have Legal Capacity, the Entity has the authority to establish and manage the ABLE Account as the Eligible Individual’s agent under a power of attorney, or if none, as the Eligible Individual’s conservator or legal guardian, or representative payee appointed for the Eligible Individual by the Social Security Administration. The Entity must certify under penalties of perjury that no other person with a higher priority on the list of potential Authorized Individuals, which consists of the Eligible Individual’s agent under a power of attorney, or if none, the Eligible Individual’s conservator or legal guardian, spouse, parent, sibling, grandparent, or representative payee appointed for the Eligible Individual by the Social Security Administration, in that order of priority, is willing and able to act as Authorized Individual.

As Authorized Individual, the Entity may neither have, nor acquire, any beneficial interest in the ABLE Account during the Account Owner's lifetime and must administer the Account for the benefit of the Account Owner. Whenever an action is required to be taken in connection with an Account, the Authorized Individual must take such action on behalf of the Account Owner.

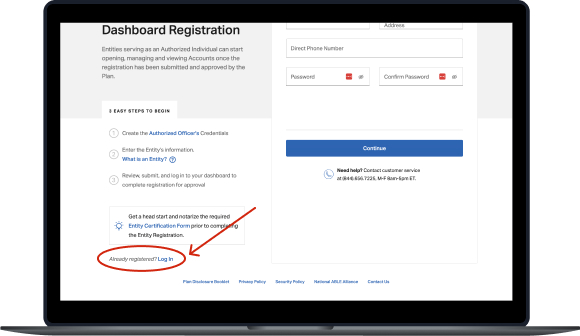

Who can complete the Entity Registration?

Entity registration must be completed and submitted by a Control Person - An individual with significant responsibility to control, manage, or direct the Entity. A Control Person may include, but is not limited to, the: Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, Managing Member, General Partner, President, Vice President, Treasurer, Executive Director/Director of a government agency, or any other individual who regularly performs similar functions. Please see

31 C.F.R. § 1010.230(d)(2). The Control Person must have the authority to make binding commitments on behalf of the Entity.

Entity information, including TIN

Team Member Requirements for State or Government Entities

Notarized Entity Certification Form

Entity information, including TIN

Team Member Requirements for Non-Profit Entities

Notarized Entity Certification Form

Entity information, including TIN

Team Member Requirements for For-Profit Entities

Notarized Entity Certification Form